WHY ARBUCKLE

With more than 50 years of experience in the oil and gas industry, Arbuckle Resources has completed thousands of successful transactions for mineral owners. We are a leading purchaser of minerals and royalty interests throughout the country. Through our simple, four-step process, we ensure our customers’ assets are sold for a fair market price in the most efficient manner.

We are family owned, and customer satisfaction is, and always has been, our ultimate goal.

We use decline curve analysis and engineering software to evaluate your mineral interest. You are under no obligation to sell us your mineral rights or royalties. Rather, think of Arbuckle Resources as your mineral resource. We are here to educate you about your mineral ownership, review all of your options, and help you make the best decisions for the greatest outcomes.

If you decide to sell part or all of your rights, there are four simple steps to selling:

Consultation: After an evaluation of your mineral ownership, we will discuss all of the options you might have to divest all or a portion of your mineral rights or royalties.

No-obligation offer: If after the consultation you are interested in an offer, we will provide a top-of-the market offer within 24 hours.

Title search: We will go to the courthouse to run the title on the property to verify ownership.

Payment: We normally pay within two weeks, and we pay by cashier’s check or bank wire, whatever you prefer.

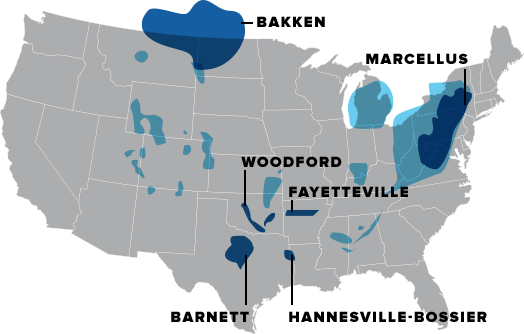

We are interested in mineral rights and royalties throughout the United States. If you own or are selling mineral interests in any of the areas in blue, fill out this short form for a free evaluation.

There are many reasons to sell your mineral rights:

Risk reduction: Over time, resources in even the hottest fields are exhausted. Exhausted resources translate into worthless mineral rights. To capitalize on their assets, many owners choose to sell their rights at their peak value.

Tax benefits: The sale of mineral rights can be classified as a Long Term Capital Gain which is a much lower tax rate than the regular income tax rate.

Cash payout: Many people prefer a lump-sum cash payout rather than waiting for royalty payments, which are usually less and less with each check.

No, selling your mineral rights will have no impact on the surface of your property.

Each royalty check is based on the production of the well along with the current price of oil and natural gas. As production and gas prices fluctuate, so will your monthly royalty check.

The value of your interest is determined by a myriad of factors, including:

Production history: Decline curves and water rates of the field and/or leases.

Reservoir formation: Some reservoirs have longer production histories than others.

Commodity price risk: As the price of gas and/or oil change, so will the price of your interest.

Future production and development

Interest type: The type of interest — whether royalty, overriding royalty, mineral rights/interest, non-participating royalty interest, or working interest — will factor into determining the value.